Repayment adaptability: Look for selections like early repayment without penalties or a chance to defer payments if required.

These predictable payments might make it much easier to manage your funds about the long run and eradicate the worry of a fluctuating amount and payment.

Having immediate deposit. In the event the lender provides the choice in between direct deposit and paper check, direct deposit is more quickly.

Your lender finalizes your cash-out refinance loan amount. After your appraisal will come again, the lender calculates your cash-out quantity by subtracting your existing loan stability from the final loan total.

Pros Welcome reward for signing up for getting direct deposit into a checking account when applying to get a loan Accepts fair credit score for loans Can involve a 2nd human being on the loan Disadvantages Prices an origination charge (1.

Autopay: The SoFi 0.25% autopay desire amount reduction calls for you to definitely agree to make month-to-month principal and fascination payments by an computerized every month deduction from the savings or checking account.

A cash-out refinance allows you to transform your own home's equity into cash for emergencies, financial debt consolidation, or An important buy.

We provide safe mobile banking that lets you conveniently handle your account from producing deposits, to sending money or having to pay bills.

Opt-in needed. Account must website have Preliminary eligible immediate deposits, must be in fantastic standing and also have an activated chip-enabled debit card to choose-in. Ongoing qualified immediate deposits and various requirements apply to maintain eligibility for overdraft defense. Only debit card purchase transactions are qualified for overdraft protection and overdrafts are paid out at our discretion. We reserve the proper not to pay overdrafts. By way of example, we might not spend overdrafts Should the account just isn't in great standing, or is not receiving ongoing suitable direct deposits, or has too many overdrafts.

Loan phrase: Shorter terms suggest greater regular payments but significantly less curiosity Over-all, although more time conditions lessen every month payments but enhance the full Price tag.

Though a cash-out refinance presents tax-free of charge cash, it’s not usually encouraged for big buys or expenditures such as a new car or vacations for a similar cause talked about over: jeopardizing foreclosure to pay for a luxurious or non-essential item is just not a wise economic tactic.

Borrowers can make use of the money from a cash-out refinance to pay down higher-fee credit card debt or fund a significant purchase. This selection can be particularly helpful when charges are minimal or in instances of crisis—like in 2020–21, within the wake of global lockdowns and quarantines, when reduced payments and a few additional cash might have been very helpful.

Personalized loans have a handful of pros, which includes a hard and fast desire charge, a fixed phrase, and glued payment. According to the borrower's credit history rating, the desire price on personalized loans could also be decrease than other forms of debt, Specially bank card credit card debt.

On the other hand, a cash-out refinance increases your loan balance and every month payment because you're withdrawing your house's equity to entry cash at the loan's closing.

Yasmine Bleeth Then & Now!

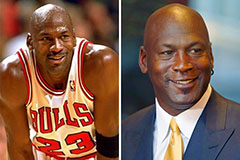

Yasmine Bleeth Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!